Direct General Insurance Explained Your Guide

Understanding Direct General Insurance: A Guide

Navigating the world of insurance can be daunting. Direct General Insurance aims to simplify this process. They offer a range of insurance products tailored to individual needs.

From auto to life insurance, they provide affordable options. Their focus on customer service sets them apart.

You can easily obtain quotes online or by calling their phone number. This guide will help you understand their offerings and benefits.

We’ll explore how to get direct insurance quotes and manage your policy. Discover why Direct General Insurance might be the right choice for you.

Stay informed and make confident decisions about your insurance needs. Let’s dive into the details of Direct General Insurance.

What Is Direct General Insurance?

Direct General Insurance specializes in providing diverse insurance solutions. They offer coverage options that cater to varying needs. From auto to life, they cover a wide spectrum.

The company emphasizes affordability and flexibility. They aim to offer insurance plans that fit individual financial situations. The wide range of services includes personal and commercial vehicle coverage.

Established as a part of the National General Insurance Group, Direct General builds on a foundation of credibility. This affiliation allows them access to extensive resources and expertise.

Here’s what Direct General Insurance covers:

- Auto and motorcycle insurance

- Life and health insurance

- Renters and homeowners insurance

With a strong presence across several U.S. states, Direct General Insurance ensures comprehensive service. They focus on customer support through innovative solutions.

Key Insurance Products and Services

Direct General Insurance offers a variety of insurance products tailored to meet individual needs. They focus on affordability and effectiveness across all offerings. Customers can choose from numerous coverage options for greater convenience.

Auto insurance is a core product, providing extensive coverage for drivers. This includes liability, comprehensive, and collision protection. They also provide coverage for high-risk drivers, ensuring everyone’s needs are met.

Beyond auto insurance, their product line extends to life and health insurance. These policies aim to offer peace of mind and financial security. Options for renters and homeowners insurance add an additional layer of protection.

To ensure comprehensive coverage, Direct General Insurance includes roadside assistance and SR-22 forms. These benefits enhance customer value by providing essential services. This makes Direct General a one-stop shop for diverse insurance needs.

Key offerings include:

- Auto and motorcycle insurance

- Life and health insurance

- Renters and homeowners insurance

- Roadside assistance

The company’s dedication to customer service is evident in these offerings. They also provide a mobile app for policy management and claims. This app makes accessing vital services incredibly convenient.

How to Get Direct Insurance Quotes

Obtaining insurance quotes from Direct General Insurance is a straightforward process. Their user-friendly online platform simplifies the experience. It enables customers to find quotes quickly and easily.

By visiting the Direct General Insurance website, customers can access the quote tool. This tool requires some basic personal and vehicle information. Within minutes, customers receive a competitive quote tailored to their needs.

For those who prefer direct communication, contacting Direct General Insurance by phone is another option. Speaking with a representative allows for personalized assistance. This ensures any specific questions or concerns are adequately addressed.

In addition, local agents are available for face-to-face consultations. This option provides personalized guidance and advice. Customers can explore various coverage options in-person with expert help.

Steps to obtain a quote:

- Visit the Direct General Insurance website

- Use the online quote tool

- Call Direct General Insurance for assistance

- Meet with a local agent for personalized service

By offering multiple channels for obtaining quotes, Direct General caters to diverse customer preferences. Whether online or in-person, they provide detailed, accurate insurance quotes.

Direct General Insurance Phone Number and Customer Support

Customer support is a cornerstone of Direct General Insurance’s service. Their commitment to customer satisfaction is evident in their robust support channels. They ensure assistance is always within reach for policyholders.

One key aspect is the availability of a dedicated phone line. Customers can reach the Direct General Insurance phone number for immediate help. Whether it’s for policy questions or claims, a representative is ready to help.

Beyond phone support, Direct General Insurance also offers other resources. Customers can access assistance through online chat and email. These options provide flexibility for those who prefer digital communication.

Customer support features:

- Dedicated phone line for assistance

- Online chat for quick queries

- Email support for detailed inquiries

- User-friendly FAQ section on their website

by iMattSmart (https://unsplash.com/@imattsmart)

These comprehensive support options ensure customers have a positive experience. Direct General Insurance prioritizes clear communication and effective problem-solving.

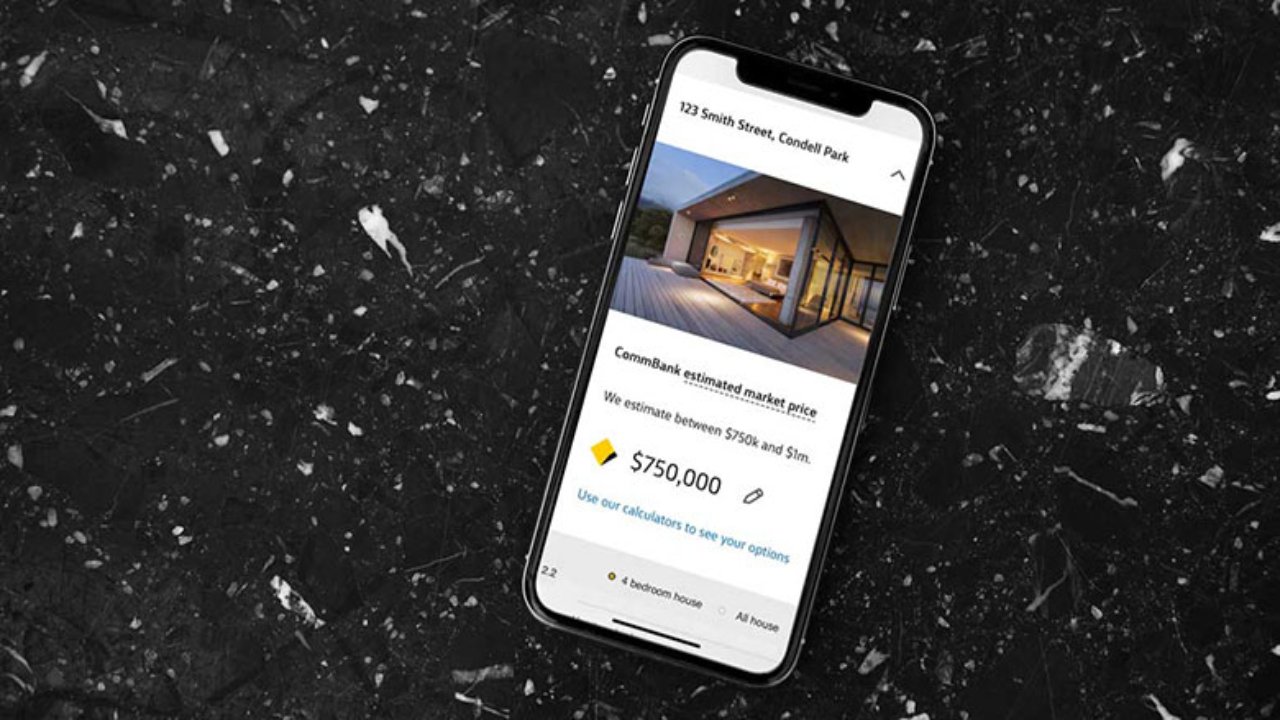

Managing Your Policy Online and via Mobile App

Direct General Insurance offers a modern approach to policy management. Their online portal is both accessible and user-friendly. Customers can easily view and modify their insurance details.

Additionally, the mobile app enhances this convenience. Users can manage their policies from anywhere. The app provides instant access to key policy information and features.

Both online and mobile platforms offer a range of functionalities. Customers can pay premiums and file claims with ease. These tools simplify the insurance management process, offering flexibility and control.

Key features of online and mobile management:

- View and update policy details

- Make premium payments

- File and track claims

- Access digital insurance ID cards

by Solen Feyissa (https://unsplash.com/@solenfeyissa)

This integrated digital solution aligns with customers’ needs today. Direct General Insurance ensures managing your policy is straightforward and efficient.

Discounts, Payment Options, and Special Programs

Direct General Insurance offers a variety of discounts aimed at reducing costs for customers. These discounts reward safe driving and loyalty. They also cater to students and multi-policy holders.

Common discounts include:

- Safe driving discounts

- Multi-policy savings

- Student discounts

Payment options are flexible to suit diverse financial needs. Customers can choose from different modes to pay their premiums. These include online payments, automatic deductions, and in-person payments.

Special programs are designed for high-risk drivers as well. These programs offer tailored solutions for those who have challenges securing insurance. Other specialty programs provide benefits like accident forgiveness and vanishing deductibles.

Available special programs include:

- High-risk driver plans

- Accident forgiveness options

- Vanishing deductible program

These programs and discounts make Direct General Insurance an attractive choice. They ensure that customers receive value and flexibility. Such benefits contribute to better budgeting and coverage satisfaction.

Claims Process: What to Expect

Filing a claim with Direct General Insurance is straightforward. The process aims to minimize stress for policyholders. Efficient claims handling is a top priority.

Once a claim is initiated, a representative guides you through the steps. They ensure all necessary details are collected promptly. This helps in processing your claim smoothly.

The claims process involves:

- Initial claim reporting

- Assignment of a claims representative

- Documentation and evidence collection

- Claims review and approval

- Payout or settlement

Direct General Insurance focuses on keeping communication clear. Policyholders are updated regularly throughout the process. This transparency is beneficial for maintaining trust.

Technology also enhances their claims service. The mobile app allows easy document uploads and status tracking. Customers appreciate the convenience of managing claims from their devices.

by Cova Software (https://unsplash.com/@covasoftware)

The goal is always to resolve claims quickly. Direct General Insurance takes pride in its responsive claims department.

Coverage Options and Customization

Direct General Insurance offers a variety of coverage options. Whether it’s auto, life, or health insurance, they provide it all. Their comprehensive services ensure every customer finds a suitable plan.

The customization of policies is a key feature. It allows you to tailor coverage according to personal needs. This flexibility is beneficial for various circumstances and lifestyles.

Customers can choose from a wide range of options, including:

- Liability coverage

- Collision and comprehensive coverage

- Personal injury protection

- Uninsured/underinsured motorist coverage

- Rental reimbursement and roadside assistance

These choices help in protecting both assets and peace of mind. The ability to adjust coverage as life changes is a significant advantage. This ensures you’re never overpaying or under-insured.

Direct General Insurance emphasizes this adaptable approach. Their network of local agents is ready to assist. They offer personalized guidance to create an optimal policy configuration.

by Sigmund (https://unsplash.com/@sigmund)

Why Choose Direct General Insurance?

There are numerous reasons to consider Direct General Insurance. The company is committed to affordability and flexibility. Their range of services suits both standard and high-risk customers.

With a strong reputation, Direct General stands out for its customer focus. The company offers tools and resources that empower decision-making. This customer-centric approach builds long-term satisfaction.

Choosing Direct General Insurance comes with several benefits, such as:

- Competitive rates for various budgets

- Discounts for safe drivers and multi-policy holders

- Flexible payment options to fit financial needs

Moreover, Direct General Insurance also supports customers with excellent service. From obtaining quotes to filing claims, they maintain simplicity. This ensures a hassle-free insurance experience every step of the way.

Frequently Asked Questions about Direct General Insurance

Navigating insurance can bring questions. Direct General Insurance addresses common concerns with clarity.

What types of insurance does Direct General offer?

They provide a variety of insurance products, including auto, life, and health policies. They also offer renters and homeowners insurance.

How can I contact customer service?

Customers can reach them via phone, email, and online chat. They emphasize providing multiple channels for convenience.

What discounts are available?

Direct General offers discounts for safe driving and bundling policies. They cater to diverse needs with extensive discount options.

Having resources like these FAQs helps users feel well-informed. Direct General Insurance aims to simplify and clarify their offerings.

Conclusion: Is Direct General Insurance Right for You?

Choosing the right insurance depends on your needs and budget. Direct General Insurance offers customizable policies and competitive rates. They focus on providing value through flexibility and customer service.

If you seek an insurer with a diverse range of options and strong support, they might be worth considering. Evaluate your requirements and compare quotes to decide if Direct General aligns with your preferences.

Have questions or need a little extra clarity? Our support team is always here to help — please don’t hesitate to reach out anytime!