Commonwealth Bank Home Loans 2025 | Best Rates & Options

Commonwealth Bank Home Loans: Your Complete Guide

Buying your first home, refinancing, or investing in property? Choosing the right home loan can make all the difference. Commonwealth Bank—one of Australia’s largest and most trusted banks—offers a wide range of options designed to suit different financial goals.

In this guide, you’ll discover:

✅ The different types of home loans offered by Commonwealth Bank

✅ Key features and benefits you can take advantage of

✅ Step-by-step process to apply or refinance

✅ Special packages for first-time buyers

✅ Tools and resources to make smart borrowing decisions

Let’s dive in 👇

Why Choose Commonwealth Bank Home Loans?

Commonwealth Bank has built a strong reputation as a leading home loan provider in Australia, helping thousands of Australians secure their dream homes.

Here’s why borrowers prefer CommBank:

- Competitive Interest Rates – Stay aligned with market trends.

- Flexible Terms – Choose short or long repayment durations.

- Smart Digital Tools – Manage everything online with ease.

- Tailored Support – Expert guidance every step of the way.

Whether you’re a first-time buyer or a seasoned investor, you’ll find options that match your needs.

Types of Home Loans Offered

1. Fixed-Rate Loans

✔ Predictable repayments for a set term

✔ Peace of mind if interest rates rise

✔ Ideal for budget stability

2. Variable-Rate Loans

✔ Benefit from market fluctuations

✔ Often starts with lower rates

✔ Flexibility in repayments

3. Split Loans

✔ Combine fixed + variable

✔ Balance between stability & flexibility

✔ Great for uncertain market conditions

4. Interest-Only Loans

✔ Pay interest only for a set period

✔ Lower repayments initially

✔ Popular among property investors

5. Construction Loans

✔ Tailored for those building or renovating

✔ Funds released in stages

✔ Matches project milestones

💡 Tip: Many borrowers prefer split loans to enjoy both stability and potential savings.

🔒 Fixed vs Variable Rates: Which is Better?

- Fixed-Rate Loans → Great for long-term planners who want repayment certainty.

- Variable-Rate Loans → Perfect if you’re comfortable with some risk and want potential savings.

- Rate Lock Feature → Lock today’s rate to avoid future increases before settlement.

Flexible Features You’ll Love

Commonwealth Bank makes managing your loan easier with added flexibility:

- Offset Accounts → Reduce interest by linking savings.

- Redraw Facilities → Access extra repayments anytime.

- Extra Repayments → Pay off your loan faster without penalties.

These features not only save money but also give you financial control and peace of mind.

How Commonwealth Bank’s Rates Compare

CommBank is known for competitive market-aligned rates. Plus, they provide tools that make comparing simple:

- Loan Calculators → Estimate borrowing power & repayments.

- Rate Comparison Tools → See side-by-side loan options.

- Transparent Information → No hidden surprises.

👉 If you’re considering refinancing, CommBank’s tools help identify potential savings opportunities.

👩💼 First-Time Buyer Support

Buying your first home is exciting—but also overwhelming. Commonwealth Bank offers special packages that make the process smoother:

- Lower deposit requirements

- Access to government grants & incentives

- Educational workshops and guides

- Pre-approval for better property negotiations

This tailored support ensures first-time buyers step into the market with confidence.

🛠 Tools & Resources

To make informed decisions, CommBank provides:

- ✅ Loan calculators (borrowing power, repayments, savings)

- ✅ Online portals to track applications

- ✅ Guides, FAQs, and educational content

These resources mean you’re never in the dark about your loan journey.

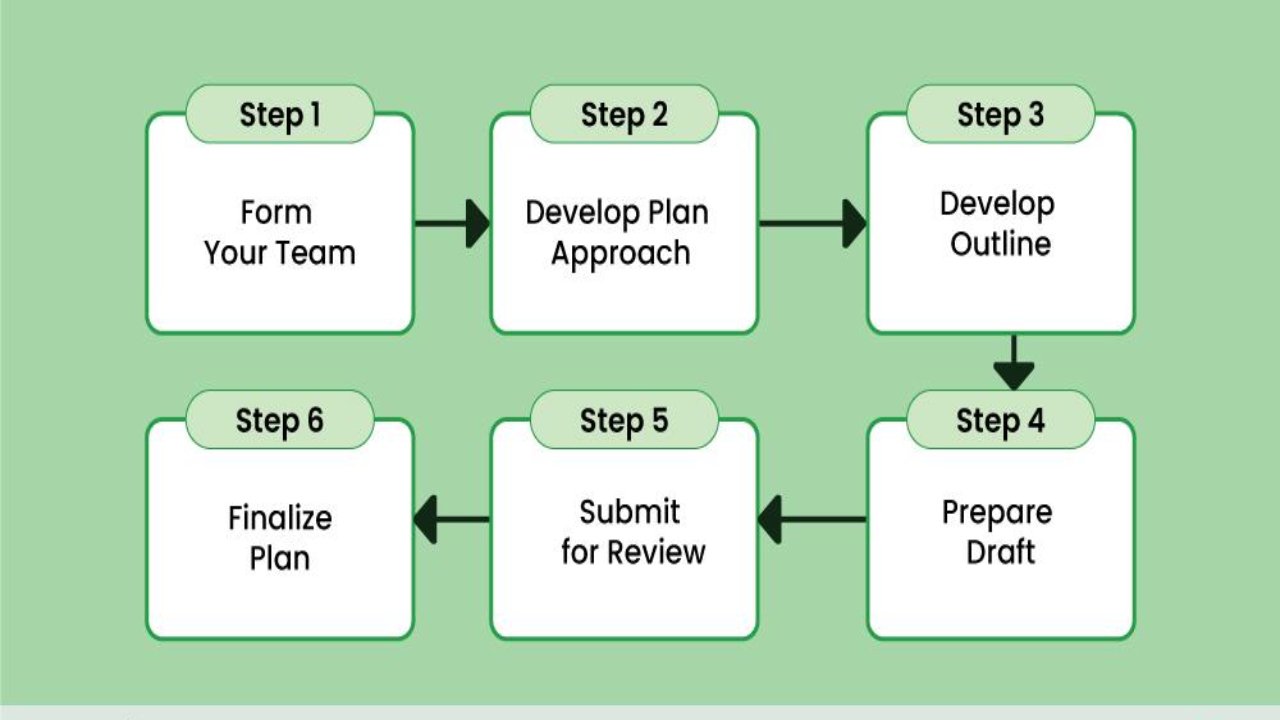

📑 The Application Process: Step by Step

- Prepare Documents → ID, income details, financial commitments.

- Consult a Specialist → Discuss goals and suitable options.

- Submit Application → Online or in-person.

- Approval & Settlement → CommBank guides you till the end.

✅ With expert support at each stage, the process stays stress-free.

Refinancing with Commonwealth Bank

Already have a loan? Switching to CommBank can:

- Lower your monthly repayments

- Give you flexible repayment options

- Provide access to expert financial advice

Many borrowers discover substantial savings when refinancing.

Frequently Asked Questions

Q: What documents do I need to apply?

A: Identification, proof of income, and details of financial commitments.

Q: Can I change my repayment frequency?

A: Yes! Weekly, fortnightly, or monthly.

Q: Do they offer support for first-time buyers?

A: Absolutely—packages, grants, and guidance are available.

Final Thoughts: Choosing the Right Loan

Your home loan is one of the biggest financial decisions you’ll ever make. Commonwealth Bank makes it easier with:

- Multiple loan options

- Flexible repayment features

- Competitive rates

- Expert support

👉 Whether you’re buying your first home, refinancing, or investing, Commonwealth Bank has a solution designed to fit your goals.

⚡ Next Step: Compare loan options using Commonwealth Bank’s online calculators and talk to a specialist today. Your dream home could be closer than you think!

Still have questions or need a bit more clarity? Our friendly support team is always here to help—please feel free to reach out anytime!